How to Safeguard a Hard Money Loan: Actions to Simplify the Refine

Browsing the economic landscape can be challenging, particularly when it pertains to securing a Hard Money Loan. These lendings, usually used in genuine estate deals, need a clear understanding of personal finances, the loaning market, and open communication with potential lenders. The process may seem complex, but with the best strategy, it can be simplified and reliable. As we discover this topic additionally, you'll find essential steps to enhance this financial journey.

Recognizing What Hard Money Loans Are

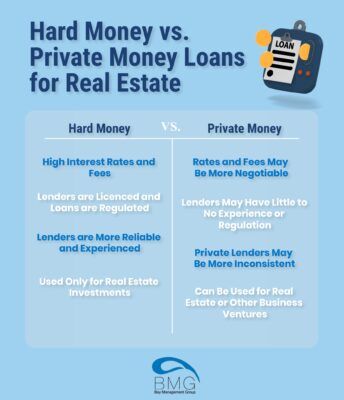

Difficult Money financings, commonly considered as the financial life raft in the vast sea of realty, are a distinct kind of financing. These lendings are essentially temporary loaning instruments, commonly made use of by actual estate capitalists to money investment tasks. Unlike conventional bank car loans, hard Money fundings are not mainly based on the consumer's credit reliability yet rather the worth of the home being purchased. Essentially, the home functions as the collateral. Lenders are little firms or private people, enabling for a more versatile and quicker process. The rate of interest, however, are significantly higher, mirroring the raised risk undertaken. Understanding these essential functions is basic in navigating the stormy waters of difficult Money lendings.

Determining if a Hard Money Lending Is the Right Choice for You

Is a Hard Money Funding the finest choice for you? The answer hinges on recognizing your economic scenario, financial investment strategies, and credit history status. This Financing type appropriates for individuals with less-than-stellar credit history, as hard Money lenders primarily think about the worth of the property, not the consumer's creditworthiness. In addition, if a fast closing procedure is necessary, a Hard Money Financing can quicken proceedings, bypassing the extensive authorization procedure conventional financings demand. Nonetheless, one need to know that difficult Money fundings commonly lug greater interest rates. Therefore, they ought to evaluate their ability to birth these costs. It's likewise essential to review the danger linked to the security, as failing to pay back could cause loss of the property. Finally, an understanding of the Loan terms is crucial.

Planning for the Funding Application Process

Prior to starting the procedure of safeguarding a Hard Money Financing, it's important to adequately prepare. Preparation entails celebration necessary documents such as evidence of revenue, credit reports, and a thorough plan of residential property usage. Applicants must also be prepared to show their ability to make Lending settlements. It's a good idea to conduct a comprehensive residential or commercial property assessment, as the value of the property typically determines the Lending quantity. A comprehensive understanding of one's economic scenario is critical. This includes knowing all debts, assets, and earnings resources. Lastly, potential debtors must be prepared for a feasible background check. Failure to accurately prepare can lead to delays or perhaps being rejected of the Financing application.

Browsing Rate Of Interest and Lending Terms

Browsing rates of interest and Financing terms can be a complex part of protecting a Hard Money Loan. Recognizing rate of interest prices, deciphering Funding terms, and working out favorable problems are crucial elements to consider. These elements, when properly understood, can significantly influence the total cost and price of the Loan.

Comprehending Rates Of Interest

A substantial majority of difficult Money Funding candidates locate themselves astonished by the ins and outs of interest prices. hard money lenders in atlanta georgia. In the context of tough Money car loans, rate of interest prices are typically greater than those of traditional car loans due to the fundamental danger included. Comprehending these prices help customers in evaluating if a Hard Money Funding is a viable remedy or if other financing alternatives would certainly be much more affordable.

Analyzing Financing Terms

Deciphering the terms of a Hard Money Financing can commonly seem like a difficult job. Lending terms, usually including the Financing amount, interest price, Finance period, and payment routine, can significantly affect the customer's monetary commitments. The rate of interest rate, usually greater in tough Money car you could try here loans, is one more crucial aspect to think about.

Negotiating Favorable Problems

Protecting desirable conditions in a Hard Money Lending includes expert negotiation and an eager understanding of rates of interest and Financing terms. One must be skilled in the characteristics of the financing market, presenting an astute recognition of current patterns and future predictions. The settlement process is vital. A debtor ought to not shy away from talking about terms, wondering about provisions, and recommending adjustments.

Understanding rate of interest is pivotal. One need to understand whether the rate is repaired or variable, and exactly how it might rise and fall over the Lending term. It's vital to secure an interest rate that lines up with one's economic capacities.

In a similar way, Financing terms must be thoroughly examined. Elements like settlement schedule, early repayment penalties, and default consequences must be comprehended and bargained to avoid any future shocks.

Assessing and Choosing a Hard Money Loan Provider

Choosing the best hard Money lender is an essential action in safeguarding a funding. hard money lenders in atlanta georgia. It calls for understanding the loan provider's requirements, examining their degree of openness, and considering their adaptability. These components will be analyzed in the adhering to sections to assist people in making an educated choice

Comprehending Lenders Standard

Examining Lenders Transparency

While choosing a Hard Money lending institution, a vital action includes examining the loan provider's openness. This aspect is essential as it guarantees that all Financing prices, conditions, and terms are clearly interacted and conveniently understood. Customers are urged to be mindful of lenders who prevent answering inquiries, give uncertain details, or appear to have actually hidden charges. It is recommended to request a clear, thorough written proposition laying out all facets of the Funding arrangement. This consists of rates of interest, repayment terms, and any kind of prospective fines. Additionally, a transparent lender will openly discuss their financing procedure, approval criteria, and any associated risks. Fundamentally, the debtor's capacity to comprehend the Finance arrangement considerably depends upon the lending institution's transparency.

Assessing Lenders Adaptability

Ever before considered the significance of a loan provider's versatility when browsing for a Hard Money Funding? Versatility might materialize in different types, such as versatile Financing terms, willingness to negotiate costs, or approval of unique security. When securing a Hard Money Financing, do not overlook the this element of loan provider versatility.

What to Anticipate After Safeguarding Your Tough Money Financing

When your hard Money Finance is protected, a new stage of the financing process starts. It is important for the customer to recognize the terms of the Finance, consisting of the passion rates and repayment routine, to avoid any kind of unexpected complications.

In addition, difficult Going Here Money financings commonly come with greater rates of interest than conventional financings because of their inherent danger. Therefore, prompt payment is encouraged to lessen the cost. It's important to preserve an open line of interaction with the lending institution throughout this phase, guaranteeing any kind of concerns are addressed immediately.

Verdict

To conclude, protecting a Hard Money Funding entails recognizing the nature of such car loans, analyzing individual economic circumstances, and finding a proper loan provider. Attentive prep work, mindful navigating of rate of interest and Funding terms, together with open communication with the loan provider can streamline the procedure. Finally, understanding post-loan duties can make certain successful Lending administration. These steps can guide individuals in securing and successfully taking care of a Hard Money Funding.

Browsing interest prices and Financing terms can be a complicated part of securing a Hard Money Finance. In the context of hard Money car loans, interest rates are commonly greater than those of typical lendings due to the fundamental danger involved. Financing terms, normally including the Loan quantity, interest price, Loan period, and settlement schedule, can dramatically impact the borrower's financial obligations.Protecting favorable conditions in a Hard Money Funding involves skilful arrangement and a keen understanding of rate of interest prices and Lending terms.In verdict, securing a Hard Money Financing involves comprehending the nature of such lendings, examining individual financial scenarios, and locating an appropriate loan provider.